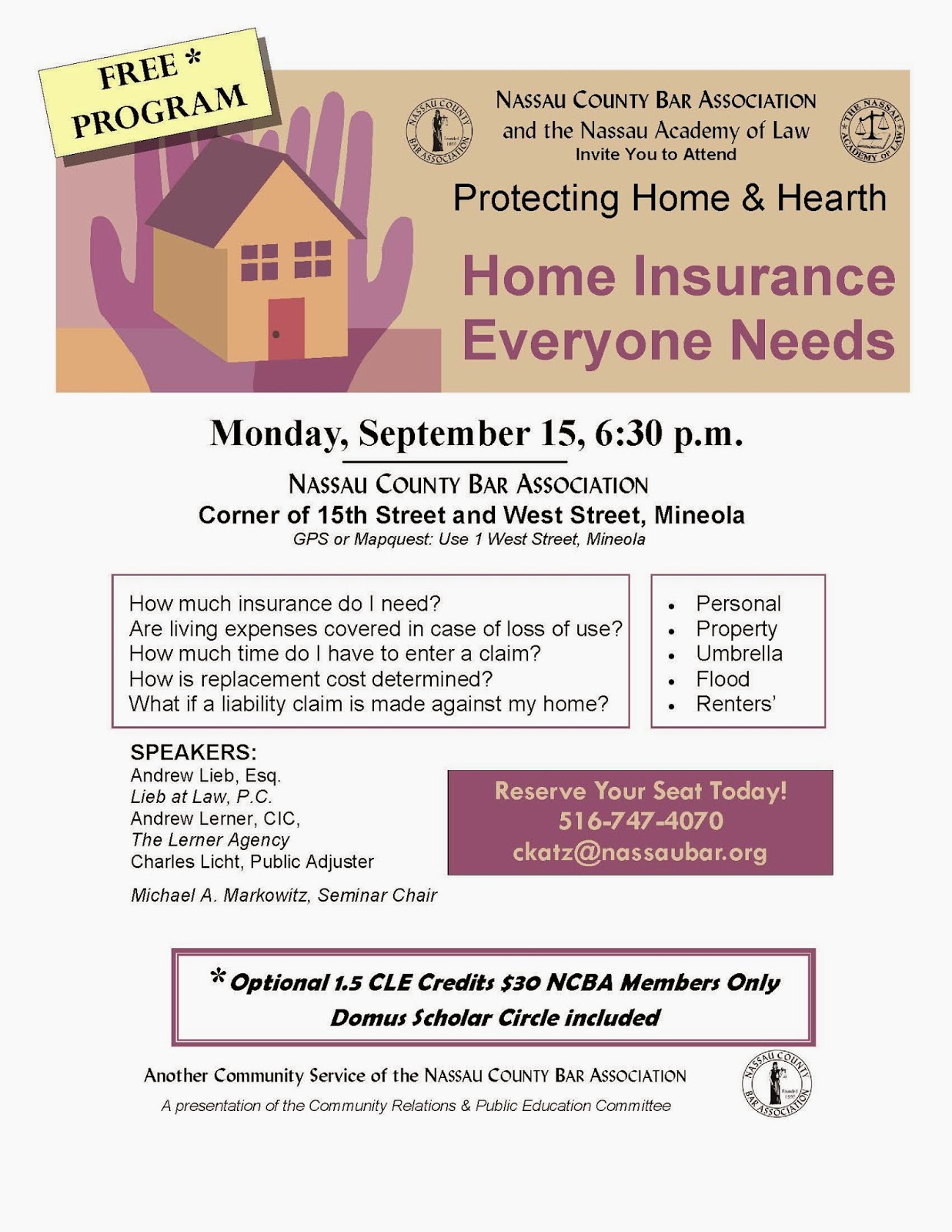

The Nassau County Bar Association and the Nassau Academy of Law Invite You to Attend

Protecting Home & Hearth

Home Insurance Everyone Needs

Monday, September 15, 6:30 p.m.

Nassau County Bar Association (Mineola)

Speakers:

Andrew Lerner, CIC, The Lerner Agency

Charles Licht, Public Adjuster

Michael A. Markowitz, Seminar Chair

To Register:

516-747-4070 or email ckatz@nassaubar.org