Now that 2017 is here it is important to be aware of the changes in the law for our industry. This is not a list about the best events from 2016, but, instead, a list that highlights the new legal landscape that you face as real estate attorneys in 2017. Being familiar with these laws, regulations and opinions may help you to better address your client’s goals and to make you money while helping you to avoid malpractice.

Topics Include:

Topics Include:

- Defaults waived in foreclosures

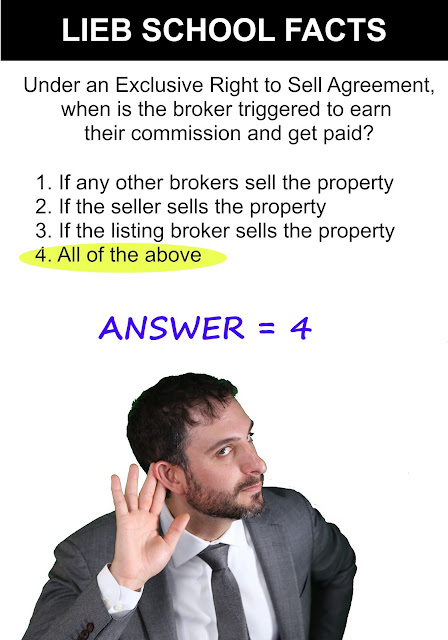

- Real Estate broker continuing education changes

- Premises liability for neighboring properties to the situs of trip and fall expanded

- Storm in Progress Doctrine includes wintery mix

- Vested right to develop requires reasonable reliance

- Vested right to develop requires legally issued permit

- Justiciability of positive declaration pursuant to SEQRA

- Condominium lien priority

- End of anonymous LLC members in NYC

- Citizenship for real estate investment trusts